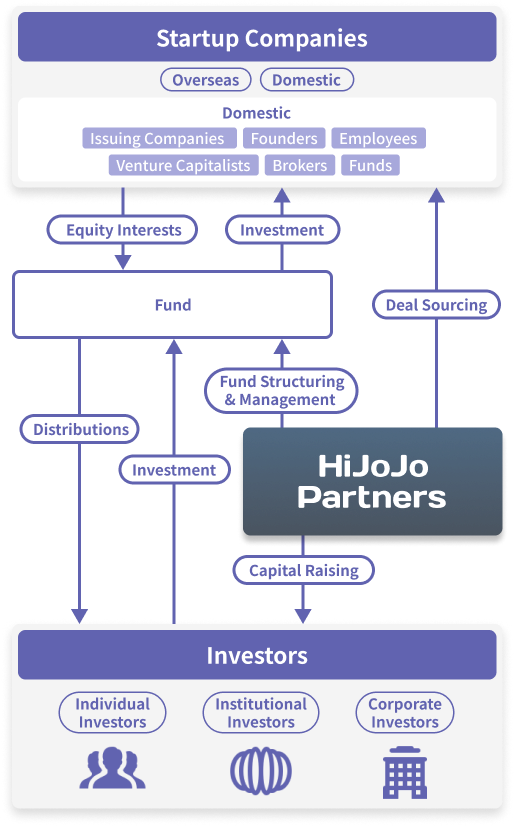

HiJoJo Partners leverages its proprietary network to source investment opportunities with high growth potential and technological innovation. By structuring funds that incorporate equity stakes in these companies, it raises capital from individual investors, institutional investors, and corporate entities. The profits generated are then distributed back to investors.

Providing exclusive investment opportunities in unicorns and high-growth companies around the world.

HiJoJo Partners leverages its proprietary global network to offer access to promising startups worldwide, including unicorn companies.

We were among the first in Japan to structure funds targeting high-growth international companies such as SpaceX, connecting Japanese investors with the world’s most transformative ventures.

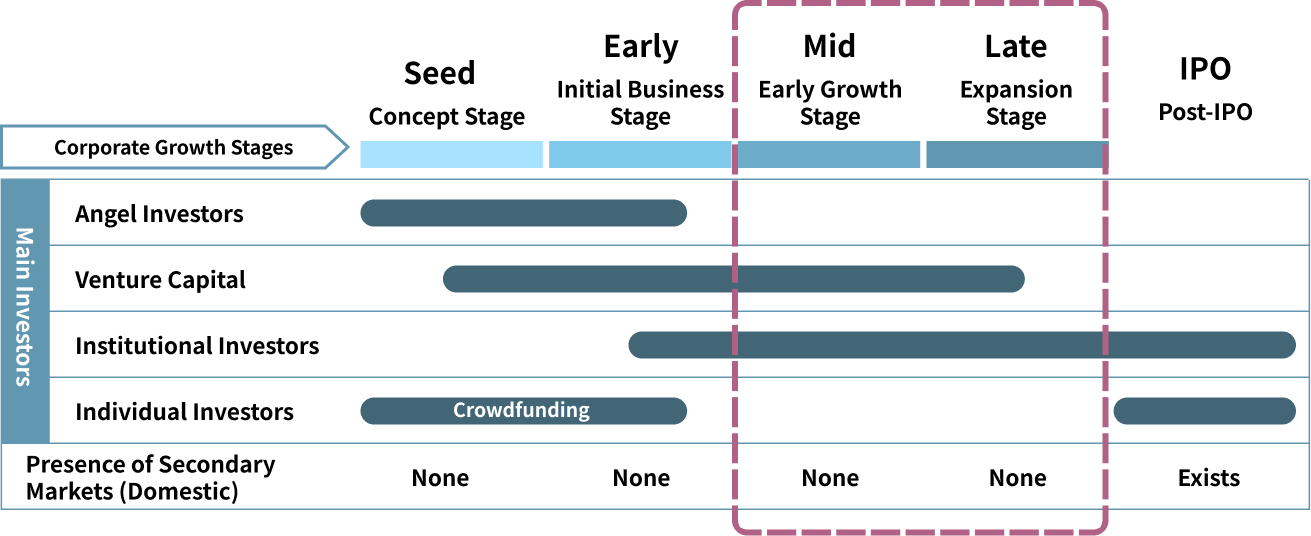

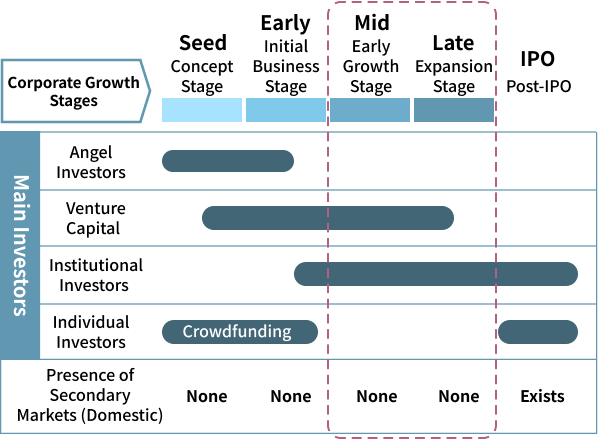

Historically, access to private company investments was limited to institutions and the ultra-wealthy.

HiJoJo Partners is changing that by enabling fractional investments in mid- to late-stage startups via curated funds—making it possible for individual investors to participate.

We aim to foster broader engagement in startup investing and help build a more vibrant and inclusive startup ecosystem in Japan.

Our dedicated advisors—formerly from leading securities firms—provide tailored investment proposals based on your portfolio and goals.

Easily register online and complete your investment entirely through a simple, internet-based application process.

We provide consulting services for IPOs, fundraising strategies, business planning, and more. We also support startup companies in evaluating investment opportunities and conducting in-depth analyses.